Human Nature and Consumer Demand

This past summer I spent some time learning about genomics from a frontier tech perspective seeking to identify areas of startup opportunity. It was fascinating to be a complete noob in a sector and absorb all of its complexities as best I could. During those months, there was one very specific consumer genomics product that I found frustrating: DNA-informed exercise plans. The question of how much our genes can inform and improve how we exercise today is not the subject of this post or what nagged at me. I couldn’t see past a more fundamental piece of the human condition that the genomics for personal fitness products seemed to have left behind in the all-out effort to market from the cutting edge – people don’t skip the gym because their workouts aren’t hardcoded to the order of their nucleobases. People skip the gym because it’s easier than going. The negative impact of skipping is not clear or felt in any immediate term. The health and fitness upside of going takes a long time to realize and consistently going takes consistent effort. In short, it felt that DNA-based workouts may have unknowingly dismissed the core challenge of motivation. Human error is the largest problem waiting to be solved by consumer fitness startups.

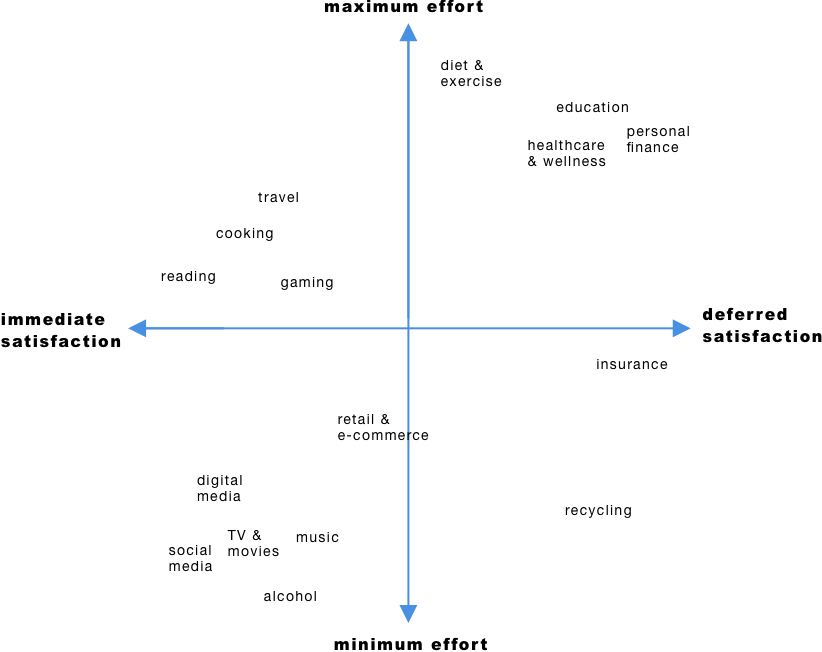

I started thinking more broadly about human nature’s influence on consumer sectors when reviewing this chart from Bureau of Labor Statistics data that Fred posted last October. What stands out to me, aside from the clearly diverging cost trends, is that the goods and services categories with dramatically increased costs also belong to sectors that require more participatory effort from the consumer in exchange for deferred outcome gratification. Conversely, the goods and services with steep cost reductions generally belong to consumer sectors that deliver much more immediate gratification with relatively minimal effort required. Referring back to the BLS chart, consumer preference (and so demand and so increasingly affordable goods and services competing for that spend) has clearly been for sectors that don’t require a lot of effort and deliver their positive impacts relatively quickly. See: TVs, Toys, Clothing, Smart Phones. In an effort to show these dynamics more clearly, I came up with the following graph and plotted a few consumer sectors here:

The x-axis represents the range of time to satisfaction from immediate to deferred. The y-axis represents the amount of consumer effort required to engage in or otherwise utilize goods and services in a given category. There is nothing scientific or data-backed in my graph. I’m just using this framework to illustrate my thinking. The categories that fall into the bottom left quadrant (lowest effort, fastest satisfaction) have sustained mass market consumer demand with two beneficial resultant effects for the consumers. First, highly competitive markets produce a greater variety of goods and services to choose from and lower prices paid for those goods and services. Second, these categories have delivered some of the most significant consumer startup successes ever (Facebook, Twitter, Instagram, Amazon, Netflix, Spotify and many others). By contrast, the categories in the upper right quadrant, in addition to seeing a spike in costs, have not yet experienced as direct a benefit from the foundational technology innovations of the past two decades.

I don’t believe this is due to lack of trying. I believe it’s due to the root human motivation to choose or engage in sectors that satisfy quickly with ease. We humans are real-time, me-first, me-now consumers. We want what we want when we want it. We stream more than we read, we use social media more than we exercise, we drink more than we recycle. Looking back through the lens of the effort vs. satisfaction graph, it makes a lot of sense that social networks and marketplaces have sustained a dominant run both in venture-backed outcomes and public market appetite and enthusiasm. Both sectors and their internet-enabled advances facilitate expedited or near-instant consumer satisfaction with less and less effort required. The same thinking can be applied to the usage and saturation of the smart phone. By no means am I dismissing any other quadrant on my graph. Yet reimagined or more challenging categories like those in the top right have problems and so opportunities that technology can and will solve. I do believe, however, that there’s a trap in expecting that the breakthrough technologies and startup models that solved for the bottom left quadrant will be as effective in the upper right sectors. The consumer motivation and engagement dynamics are completely different.

When the inputs change, the outcomes do too. The innovations that produce smarter, faster, cheaper for sectors like education, personal finance, and health-wellness may look and function in ways contrary to or at least diverging significantly from what’s come before. It warrants a deeper examination of how these sectors operate before assuming that the answer is an app for that. Individual human nature is the essential creator of consumer demand. Demand establishes markets and drives competition. Competition combined with sustained demand fuels real innovation. As entrepreneurs and investors taking aim at these sectors, we may need to key into human nature more now. Working to evolve consumer perceptions and nurture nascent demand can lay the groundwork for building truly novel startups that solve the appropriate problems and advance whole industries.