Pandemic Binge

Right now, it honestly feels more like we’ve slipped dimensional seams of the multiverse and are now living in an alternate reality in 2020. It seems like many sectors and business models that survive the pandemic may emerge in a post-vaccine world almost unrecognizable, by look and function, than they did up until mid-March.

Predictions populate the startup sphere at the end and beginning of each year: times of reflection and looking ahead. Right now, it feels more like we’ve slipped dimensional seams of the multiverse, living in an alternate reality in 2020. Since we’re all new to a global pandemic driven by a virus so fluid that it has forced swaths of the world population to shelter in place, I’m thinking about industries that are transforming in the time of coronavirus. It seems like many sectors and business models that survive the pandemic may emerge in a post-vaccine world almost unrecognizable. I’m starting here with three entertainment categories: Broadcast Cable Networks, Movies - Theatrical Release, and OTT Streaming.

Broadcast Cable Networks

Over the past 5 years, cable TV has seen cord-cutting go from a dismissible future concern to a clear and present threat as subscribers steadily cancel service for OTT streaming. Grim Q1 subscriber churn set the table for the quarantine economy to hasten cable TV’s decline. It suggests a tenuous future for the business post-COVID. Combined, the big four pay TV providers lost 5% of their paying subscriber total in the first three months of this year. As lockdowns swept the country, cable TV lost its most dependable, differentiated, and defensible entertainment moat: live television. Live sports are all on hiatus; other live events have been cancelled. Morning and late-night talk shows are shadows of their normal production. The single, scary topic on daily news has overstressed viewers tuning out.

For now, at least, the timing of corona lockdowns offers a tiny bit of solace for broadcast cable reeling from the collapse of their live tv coverage. The majority of networks’ series and programs currently on the air are pre-recorded and can run as planned through the end of the spring season. Airing reruns and old movies is standard on network TV during the summer months, audiences are used to that lull. Unfortunately, that timing band aid won’t last. Interviewed on a Ringer podcast at the beginning of April, director and writer Alan Yang laid bare the a looming issue for TV and Film…“the lockdowns obviously delay series that are airing now and were still in post on a season’s final episodes...but the real problem will be delayed...more like 6-8 months from now because nothing is getting produced now that would air/premiere six months ahead from today.”

Scripted network television operates on a set 12-month calendar to ensure development and promotional stages have adequate lead-time running up to predetermined release dates. The annual ops year has remained largely the same as it was when the networks launched in the 1940s. So, the plan for 2020 was no different. Coronavirus lockdowns have likely erased six months of spring and summer production. All major networks are facing the brutal likelihood of arriving at their broadcasting start month with none of their returning series or new pilots ready to air. Prior to the rise of OTT streaming, that reality would be painful for cable networks. Today, a September without cable’s returning lineup will likely have long-term consequences for whether or not the businesses survive post-COVID.

Cable providers and broadcast networks do not have consistently robust archives, especially of movies. Due to the complexity of licensing between all entities involved, there’s major inconsistency in what’s available when on-demand in terms of old shows, earlier seasons, and licensed movies from each channel. Furthermore, most networks-providers digital and mobile interfaces turn “ease of access” into a struggle for viewers. Many channels require the user to choose to make each show available on demand, while the cable provider interfaces treat each network like a siloed channel interface. Nothing is easily available within a few clicks.

In the absence of live sports, there’s already been rumbling from customers for refunds from pay TV providers If those same customers are left with nothing but series reruns and limited movie options, cord cutting could be fatal for cable TV. There is a chance here for cable networks to finally experiment with new models for introducing new content, timetables for development, and catching up with the competition in web/mobile experiences.They have nothing more to lose by trying, though it will require a brutally honest recognition of past mistakes and failures. For instance, broadcast networks still rely on an expensive slate of productions, with just a few hit series retaining audiences year to year. Since 2010, across all networks, 58% of original programming is cancelled every year. Furthermore, clinging to outmoded pricing from legacy customers who may not realize what they’re paying is a failing proposition. In 2020, the average cable TV customer STILL pays $107/month for the box and bundle. That same customer could stack 4-5 OTT platforms and still save on the cable bill today. There may be a path forward post-corona virus, though it will require reducing expectations of revenue and growth for now.

Movies - Theatrical Release

For the film business, where both creating supply and realizing demand depend on the ability of large groups to gather, the coronavirus lockdowns have already paralyzed the industry. With productions delayed indefinitely, studio lots vacant, and theaters closed, the Hollywood box office, which normally earns $11B annually, has been taken off the board. Not unlike cable TV and cord cutters, moviegoing audiences have been gradually shrinking for twenty years. In 2018, 336 million fewer movie tickets were sold compared to the industry’s peak in 2002. The rising cost of movie tickets -- nearly doubling over the same period -- has obscured this decline from reflecting in top line revenue. That contraction has not frozen the whole business, but I think there are a few emerging consequences of a Hollywood on ice during the virus.

There is a real possibility that theaters won’t reopen on a scale that facilitates standard nationwide premieres for the foreseeable future. In response to that scenario, many major theatrical releases planned for the end of the year are being pushed back into 2021. Even films that had scheduled domestic releases much later in 2021 are pulling the theater plan and cutting deals to premiere on Netflix or other streaming services instead. The new production gap mentioned above will also severely limit the number of films in the can and ready to be released in the fall/winter even if theaters are open. Arriving at the end of the year with no star-studded blockbuster films hitting theaters will slaughter box office revenue and could shatter the theatrical release distribution model. November and December are crucial for the film industry, accounting for more than 40% of the $11.3 billion total domestic box office revenue in 2019. If studios and theaters rush to spin-up some theatrical re-releases of popular or classic films to fill the void, those will likely turn out a fraction of the dependable, large audiences normally seen at theaters at the end of the year.

The emotional reluctance of moviegoers and state timelines to officially reopen businesses are intertwined. Even if some productions make it into the theaters, even if the virus is tamed and distancing guidelines relax, every day that passes makes it harder to imagine moviegoers venturing out to crowd into theaters in numbers anywhere near the projected norm for the box office. People are going to be cautious and will be warned to take small steps towards reengaging in normal activity. Large gatherings, especially with whole families, will probably be among the last consumer events to come back to life.

The longest-lasting negative consequence for studios and theaters arises from the complete shuttering of their businesses while their major industry competition, OTT streaming platforms, are surging to new heights. Streaming offers homebound movie lovers of every age and demographic a cheaper, safer, high quality alternative in bottomless quantity. I wouldn’t be surprised if, in a post-COVID world, theatrical releases and going out to the movies settle into niche consumer activity. Existing theater businesses like Alamo Drafthouse nationwide and Nighthawk Cinema and Metrograph in NYC are already serving the market. These theaters have full-service kitchens, high quality menus, and full bars, all of which can be accessed throughout a film from your seats, which are La-Z-Boy quality plush. Such models would significantly reduce overall box office dollars and, as a higher-priced cinematic experience, would likely be reserved more for special occasions and special films rather than remaining a regular family experience.

OTT Streaming

A lone bright spot in battered public markets, Netflix shattered analyst revenue projections in Q1 2020 by adding 16 million new subscribers. At first blush this might seem extra impressive given the pandemic. Growing their total subscriber base by nearly 10% in one quarter is amazing for sure, but not the shocker that blindsided Wall Street. Reid Hastings said in 2018 that his company wasn’t competing with all the other new streaming options, Netflix was competing with our sleep. A global shelter-in-place order is a dream come true for the company that invented binge watching and is by far the closest thing to a generic eponym for streaming services. Netflix in particular and the OTT category broadly are uniquely built to thrive and lead during COVID and immediately thereafter.

The lockdown confinement advantage is a major positive swing for OTT providers right now. We are all stuck at home, with very little to do, hungry for distractions, delights, and diversion from the real world outside. Of course, it will end at some point and viewership hours will revert to normal. However, given the probability of a more enduring economic downturn as well as the subscription model for all the TV providers (OTT and cable), this lockdown surge won’t be a one-time blip in streaming popularity. Within OTT streaming’s most unprecedented collective binge, there’s a distinct exercise happening with real implications for OTT long-term retention. Approaching Month 3 of lockdown, viewers have binged beyond their favorite programming lineup and so, consciously or subconsciously, are devoting many hours evaluating their content providers: How deep are their libraries? How many genres do they cover? How easy or clunky are their interfaces to navigate?

This degree of rigorous kicking of the tires doesn’t really happen in the course of peoples’ normal, busy daily lives, but life during coronavirus is a whole new world and, while I’m not a fan of the phrase, content is the king we’re all kneeling before right now. There’s no way the powers that be could have predicted the lockdown, though it seems prescient of Netflix to have dropped so much acquisition money over the last few years to beef up their library alongside all the original programming. Expect to see a much higher degree of long-term consumer lock-in for the OTT providers they choose during a period of intensive consumption.

A regular thread in the emergence of the OTT competitive field has been how much signing up for multiple streaming services feels like cable bundle and will soon cost more too. In reality, the cost comparison is the opposite. Shockingly, and likely aided by a substantial number of long-term subscribers who don’t know better, the average monthly cable TV bill is $107.00 in the U.S. $107!!! Add up monthly subscriptions to Netflix, Hulu. Disney+, HBO Now, and Apple TV and at $45/month this streaming bill saves consumers more than 50% compared to cable. They could even add in a Live TV OTT like YouTube TV and still pay less than the current cable bill.

That true cost comparison will likely be revealed to more consumers due to pandemic impact on the economy. Payer price sensitivity is being felt in an acute spike, especially for those on lockdown without any income. It will have an even more widespread impact in a post-COVID economy with consumers looking for ways to reduce their monthly expenses. The custom streaming bundle is cheaper than pay TV head-to-head regardless of pandemic. In a pandemic country on lockdown, with cable TV having lost its live programming advantage, the inflated cable TV bill seems all the more glaring. Switching to OTT providers will be a no-brainer for more consumers. The cord cutting floodgates may just burst open in the months ahead.

When Netflix dropped all of the first season of House of Cards in 2013, the company blew up the timed-release marketing-distribution playbook that was industry standard. The company took a significant risk on the notion that, if the content was good, audiences would swap anticipation and premieres for volume and availability. That theory proving out since, they’ve been rewarded with ultimate flexibility and autonomy in how and when they release. Not beholden to concrete lease plans, they can be strategic and responsive to genre popularity trends. They can test bolder creative risks on a 365 days-a-year release window. And, they can adjust on the fly to external issues, from production delays to global pandemics, without sacrificing their style or reputation. We’re used to Netflix as a place to find interesting stuff to watch, stuff that often experiments with episode, season, and series constraints. This makes dynamic OTTs more durable through an industry-wide production shutdown. Interruptions, delays, and some shows that just don’t come back -- all are much more copacetic on Netflix and streamers. For broadcast networks with audiences trained to watch on a regular and consistent programming schedule, these same issues may cause much more friction.

--

A coronavirus effect on the entertainment industry so far seems to be accelerating the adoption curve for new technologies transforming how we watch TV and movies. Life in lockdown won’t last forever, but post-pandemic Hollywood may reveal an industry that’s leapfrogged a few stages in the broad shift to being streaming-first.

Here Be Dragons

As a history nerd and a fan of cartography, I fell in love with the intent of the phrase Here Be Dragons, first found etched into the Hunt-Lenox Globe, c. 1504.

A few weeks ago, I went to the Special Collections – Rare Books Division on the 3rd floor of the New York Public Library’s headquarters at Bryant Park to see The Hunt-Lenox Globe. As a history nerd and a fan of cartography, I fell in love with the intent of the phrase Here Be Dragons, first found etched into the Hunt-Lenox Globe, c. 1504. On the earliest maps of the world, here be dragons identified areas that were either unknown or rumored to be perilous to seafaring travelers. Avoid at all costs. It’s my title because the phrase strikes me as an appropriate identifier for the perilous and unpredictable state of our rapidly warming planet. Where Here Be Dragons was once reserved for remote corners of the map to avoid, in 2019 it can justifiably represent every inch of the globe that none of us can avoid. As we knowingly push the planet up against any known limits of its ability to sustain human life, I want to write a few thoughts on what new trouble may be immediately around the corner, areas of innovation emerging to lead us into a survivable future, and finally some dead simple, minimal effort changes anyone can make in their day-to-day to meaningfully help avert catastrophe.

I don’t put this into words in order to try and convert climate deniers into advocates. I’m really appealing to the apathetic majority, that represents the largest population and so the most cumulative potential to actually fix things. The generally good people who still rib their colleagues saying things like well I’m no tree hugger to absolve themselves or who may be unmoved or simply overwhelmed by the events and heavy statistics now being recorded every day on our planet. And, I’m writing this now because, honestly, I do not know what else to do. So here goes, for anyone who reads through, I really appreciate it and hope it’s helpful.

Part I. Endless Summer

Coastal Property Value Collapse

Today, one in three U.S. residents live on a coast, to be specific in a county directly adjacent to the Atlantic Ocean, the Pacific Ocean, or the Gulf of Mexico. As a matter of function and fashion, our coastlines also store a staggering 73% of the total value of the U.S. housing market.[i] Naturally, coastlines bear the brunt of impact from storm surge and sea-level rise. News headlines tell the stories of coastal damage and recovery efforts in the aftermath of a major storm. Foreclosures in the Rockaways, Houston-area communities abandoned, Miami underwater from king tides. Between the lines of losses from any one storm, more devastating consequences are eating away at the long-term viability of the coastal real estate market. Analyzing data compiled by HUD, the four primary indicators of housing market health – total new homes on the market, total new home construction, average number of transaction, and average transaction size – have all been on a decade-long decline in U.S. coastal counties, by as much as 11% in certain regions.[ii]

As of yet, no single storm has permanently drowned a housing market, but recovery in the face of more intense and frequent extreme weather now means unrecoverable losses of value that can’t be rebuilt or made whole from insurance claims. Examining the strength of the coastal housing market relative to comparable inland control groups exposes the negative impact that sea-level rise has already had. Research from First Street Foundation and Columbia University found that the eastern seaboard has already lost a combined $15.3 billion in relative property value due to the impact and growing risk of tidal flooding since 2005.[iii] The lynchpin preventing collapse at the moment is a vital safety net for all real estate markets: insurance. Proof of property insurance and, in coastal and flood plains states flood insurance, are required for all FHA mortgages to protect the value of the loan. Insurers don’t like to pay claims; they really don’t like to payout full policies; they don’t make bets when the odds aren’t in their favor. When a coverage area experiences a higher rate of policy payouts, the losses can be severe short-term – bankrupting California’s largest public utility in January – and long-term if property insurers stop binding new policies in the area at risk.

Effectively declaring a locality uninsurable is a death sentence for its real estate. Real estate markets begin and end with insurance. If you can’t get a property insured, then you can’t get a mortgage. If you can’t get a mortgage, then you can’t own a home. The inability to get new mortgages or refinance existing ones is a mounting possibility in coastal communities and the trigger that can take a slowing market into a collapse. Panic sets in for any sector when new business can’t be done and, for coastal homeowners with significant net worth tied to properties at risk, there is very little action that can be taken to reverse the losses.

For some, the extreme flooding headlines haven’t hit home yet as, to date, the surge in tidal flooding has had a more pronounced impact on coastal geographies that aren’t as wealthy. Many rich coastal enclaves have spent the past ten years building extravagant protections for their properties, including steel stilts, elaborate sump systems, and erosion barriers dredged from sand on the bottom of the ocean. No matter how expensive these Band-Aids are, they only delay the inevitable. Tidal flooding and global weirding are indifferent to socioeconomic status. No matter how insulated a beachside mansion is from extreme weather, the property value evaporates if the surrounding area is abandoned or submerged. You can’t throw money at problems this complex. Unfortunately, it stands to reason that the headlines will become most dire when the playgrounds of the rich come under flooding threat. First Street Foundation and Columbia University conducted a follow-up study to examine the projected risk to coastal property value from 2019 onward. Over the next decade, the Hamptons, West Palm Beach, and Cape Cod stand to lose a combined $10.4 billion in property value.[iv] There’s bright red writing all over the walls at this point. Its straightforward to understand the massive, collective loss of wealth that would result in a full-scale write-off of coastal properties. More likely to be a sledgehammer to the cogs of the system than a bursting bubble, there’s a point of no return, literally, when mortgages start being denied across the board.

Population Density Endures Extreme Weather

The total population of the U.S. has doubled since the mid 20th century, thanks primarily to hyper population growth on the country’s coastlines and in the eastern floodplain.

United States Coastal and Eastern Floodplain Regions

In fact, since 1960, the three U.S. coasts and the eastern flood plain have combined to outpace global population growth by 2.5 times.[v] Layering the above map over the U.S. population distribution maps for 1960 and 2017 from the US census bureau highlights this concentration.

United States Population Distribution, 1960

data source: U.S. Census Bureau

United States Population Distribution, 2017

data source: U.S. Census Bureau

The problem is that these two regions are the most susceptible to direct impact from the two most destructive natural disasters: flooding, across the board, and wildfires, specific to the pacific coast. In recent years, two emerging trends of global weirding related to climate change are amplifying the risk of living in these areas: the increased severity and frequency of natural disasters. That we’ve entered new territory for natural disaster severity is evident in the FEMA historical archive, where a new record for total damages seems to be set with virtually every successive storm, flood, and fire. Over the past ten years, we’ve experienced the seven worst hurricanes, the three worst wildfires, and three of the four worst floods ever recorded in the U.S.[vi] The mounting losses from any one of these events, by measures financial and otherwise, are obviously enormous. In the shock reaction to each extreme weather event, the accelerated frequency with which they happen can become obscured. However, the country is now enduring successive natural disasters at an unprecedented clip. In a 27-day period in 2017, hurricanes Maria, Irma, and Harvey destroyed $300 Billion of property.[vii] Just two weeks ago, the National Weather Service announced a new record for the largest number of simultaneously active named storms:

source: National Weather Service via weather.com

Extreme weather that’s more costly and more common is a trend that’s been building steadily over the past three decades. FEMA is responsible for official weather declarations and includes earthquakes, floods, hailstorms, blizzards, hurricane storm surge, tornados, and wildfires in its categorization of natural disasters. Up until the late 1980s, the United States averaged fewer than 30 individual disaster declarations per year. Since 1990, the country has experienced an eye-popping 4x increase in annual natural disasters. When the same areas are hit, harder and harder, and much more often, there is a compounding effect on the costs to recover. The graph below charts the 30-year trend in natural disaster declarations along with the resultant annual damages in dollar terms, which have grown 10x.

data source: FEMA.gov

While extreme weather is indifferent to wealth, the immediate term effects will differ depending on it. Rich people in these areas may see net worth shrink or may flee immediate danger zones, poor people will lose lifesavings or entire homes without financial protections that allow them to rebuild. Ultimately, though, we are all at extreme risk. If the natural disaster trend lines above continue unabated, everyone stands to lose everything.

Our Diets Are Forced To Change

Over the past few decades thanks to advances in large-scale machine-based harvests and yield management technology, we’ve become remarkably efficient at farming. Some analysts would argue we’re way too good at it. The prodigious production that’s filled groceries with fresh everything and given a few generations lots of options for what we eat still depends on arable land to graze livestock and plant crops and seasonal weather to sustain both and harvest appropriately. Without predictable rainfall, the system stops producing. Climate change and global weirding threaten to upset the delicate atmospheric balance that’s given us the opportunity to feed ourselves in such abundance.

There are two crippling agricultural consequences of temperature increases: high-intensity rainfall and extreme drought. This doesn’t sound like it makes sense as one could solve the other. However, it’s that type of uninformed logic that’s allowed far too many people an out to dismiss the entire crisis. These two events don’t happen in predictable sequence or in the same places. When air warms, it holds more moisture. More moisture in the air makes more intense rainfall when it happens. Unexpected heavy rainfall can ruin crops outright and any instance where flooding occurs can render entire fields useless forever. A temperature increase also accelerates groundwater evaporation. This in turn creates extended droughts and water shortage. Today, 80% of the world’s crops are rain-fed and another 10% are irrigated with groundwater.[viii] Keep in mind that crops don’t just mean the vegetables we eat, corn is the primary resource used to feed livestock globally.

So, as you can see, the strain on our food supply as a result of small climate increases is being felt and can continue to get worse without urbanites feeling any meaningful difference in their own temperatures or extreme weather. At the moment, crop yield for the top 10 most commonly produced, imported, and consumed foodstuffs in the U.S. is decreasing by 1% every year.[ix] That’s in current circumstances and despite all of the farming advancements. Might not seem like much however it amounts to enough calories to feed 50 million human beings wiped out, every year. Those foodstuffs categories include or directly reduce: avocados, beer craft and otherwise, every cut of red meat, and, yes oh yes, coffee.

Like the coastal housing section, the immediate term consequence from our economic and food system will be rich people stockpiling through expensive imports and everyone else struggling. Also, in any complicated crisis, things tend to get uncomfortable first and unlivable later. Ideally, you start changing your eating habits now, but if you’re a stubborn beer swilling, steak and potatoes manly man, be prepared to pay craft brew and filet mignon prices for Natty Ice and Salisbury steak quality.

4 Seasons become 1 and 1/4

This impact may seem more superficial than the previously three, its not and its onset sucks either way. Anyone living in the Northeast United States for the past decade has already started to experience this reality: our transitional seasons, Fall and Spring, are rapidly disappearing and a winter is becoming a short, frozen blast. The definitive and only culprit is global temperature increase. Since 2010 in Central Park, the average temperatures for March and April as well as September and October are 3 degrees Fahrenheit higher than the average historical temperatures for those four months since we started recording them.[x]

A three-degree bump may be pretty easy to ignore, especially in modernized big cities. We may even welcome it. There may be no more significant factor contributing to societal apathy towards the climate crisis than the broad human preference for warmth over cold. Everyone loves sun shiny days. We don’t balk at an earlier spring thaw or do anything beyond celebrate extra summery days into October. Maybe there’s passing regret for fewer days to see the foliage change or a shorter PSL season. Like many slow-build calamities in history, rising temperatures may well be hailed as a pleasant change, right up until the moment that it’s too hot and, unfortunately, too late to do anything about it.

The direct implications of fundamentally changing our planet’s natural seasonal progressions are dire. A shift from air conditioning as a comfort to relying on it in order to function will put unsustainable pressure on the country’s energy utilities, many of which are already giving out under current, skyrocketing resident demand (see: PG&E, California’s largest utility, bankrupted by wildfire related insurance claims last year and instituting mandatory black outs today). With broad medical acknowledgement of seasonal depression, it’s not difficult to imagine the new physical and emotional health problems that will result from life lived indoors. Furthermore, the intermediate knock-on effects are extreme and destructive. Shorter winters means less annual snowpack in the country’s western ranges. So, for the wealthy, ski trips become memories from yesteryear. Far more importantly, snowpack that melts earlier in the season causes unexpected flooding throughout the Midwest and contributes to harsher, longer drought west of the U.S. mountain ranges into California.[xi]

As with many of the climate crisis effects today, the seasonal disruption is less a doomsday prediction and more an increasingly present reality. 2018 was the fourth hottest year on record. The three years ahead of it? 2015, 2016, and 2017. There are solutions that can help solve this problem and they need dedicated, intelligent minds to see them through. If the three degrees Fahrenheit bump we’ve already experienced becomes six, then eight, then 12, the great outdoors will become largely off-limits for human beings.

Part II. Effective Innovations

Alternative Protein Delivers

There are few sectors where the supercharged startup hype machine has been more tangibly beneficial than plant-based proteins and alternative meats. With a better than expected IPO from Beyond Meat, fast food chains lining up to rapidly deliver distribution to mass consumer segments. Progress has been made when general consensus moves from sounds gross, tastes not as good to oh wait, its delicious? And its cool? American tourists are now visiting New York City not for pizza or steak but for a hamburger made from plants. Thank you David Chang.

The chasm we now must cross is in expanding and diversifying the menu, so that the current dietary evolution doesn’t stop at the impossible burger. Culturally, we must overcome the culinary subset of toxic masculinity that says manly men eat meat. A concept that’s deeply ingrained in American identity and extremely detrimental to the environment. The enduring demand for beef in the states drives subsistence farming tactics like slash-and-burn methods in other parts of the world and puts exponentially more carbon into the atmosphere – more than any other contributing factor. The most important thing to remember is that this dumb western edict isn’t true. However, you define ‘manliness’ it can be achieved without meat. You can get yoked in the gym off plant-based protein and it’s much better for your overall health.

If we can course correct our consumption culturally and continue to embrace entrepreneurial efforts to set out tables with delicious alternatives, then prices will become competitive and everyone will be able to benefit. Here are some delicious alternatives startups emerging today: Soylent, Hungryroot, Exo Protein Bars, Ripple Foods, Wild Type and Simple Mills.

Renewable Energy Achieves Pricing Parity

Historically, alternative energy options have been limited by non-competitive pricing. The mass market wouldn’t pay a premium for renewable energy, in their homes or their cars. This is because consumers don’t want to spend extra cash for an intangible or indirect benefit, or they simply couldn’t afford to do so. Thanks to the indomitable efforts of scientists and entrepreneurs, those prices are finally dropping to a point that they are competitive with traditional fossil fuels, without subsidies.

There are two particularly remarkable areas of innovation that helped make renewable energy an affordable option. One is on the energy sourcing side and the other is on the energy storage side. The first is rapid progress in solar photovoltaics, or solar panels. A unique attribute that’s allowed meaningful adoption of solar panels ahead of the pricing parity curve and other renewables is how easily panels can retrofit to existing infrastructure and plug into traditional energy grids. Citibike docks are powered by solar panels and new buildings regularly install solar panels on new roofs. That early adoption combined with persistent research and development to increase panel efficiency have brought the price of solar panels down 73% since 2010.[xii]

The cost to store alternative energy and still have it readily available to use has contributed to limited adoption of hybrid and electric vehicles (EVs) up to this point. The average MSRP for electric vehicles still hovers about $10k more than comparable gas-powered vehicle models. There’s been notable progress recently in the reducing the price per kilowatt hour of energy storage in the lithium-ion battery packs that run electric vehicles. Electric vehicles face a dual challenge in needing to lower costs that produce a battery pack with a significantly increased carrying capacity. In order to compete with gas-powered cars, EVs need to price competitively and be able to drive longer distances, faster, on a single charge. Fortunately, both these requirements are rapidly being met by the industry. As the chart below shows, the cost of lithium-ion packs for EVs has dropped 80% since 2010 is projected to continue to fall.

This breakthrough will allow EVs to price at parity with and eventually be significantly less expensive than filling up a tank of gas. The significance of continued development of lithium-ion battery efficiency and capacity can’t be understated. In fact, just last week, the scientists responsible for many of the innovations in this field won the Nobel prize.

Autonomous Fleets Reduce Carbon Emissions

Deforestation is the single largest contributor global warming, but combustion engine emission is a close second.[xiii] There about as many positive are there are negative opinions and headlines regarding autonomous driving right now. I believe that’s to be expected. Autonomous systems are incredibly complex to build, test, and prove out and the technology is only just emerging. Furthermore, when a new technology has the potential to dramatically change a massive incumbent industry like auto manufacturing as well as the predominant means of transportation over the past 100 years, dismissiveness and flack are inevitable. (FWIW, the automobile endured the same fearful headlines during the early 20th century).

As it pertains to the climate crisis, I’ll focus on the impact of autonomous vehicle adoption at scale. Though it’s cool to experience taking your hands off the wheel in a Tesla today, independently autonomous vehicles (AVs) are more demo than endgame for the industry right now. The profound shift will be AVs that operate as fleets or on an interconnected mesh that lets them adjust speed, acceleration, deceleration, and directional path in real-time coordination with one another. This would represent a step-function improvement over the status quo where each driver decides all of those variables on their own. Human beings aren’t good drivers. That’s not to say we aren’t intelligent enough to get licensed and drive. It’s just that we are constantly distractible. That danger combined with incongruous acceleration and breaking are what create traffic congestion and what kill 100 people every day in auto accidents in the U.S.

AVs on connected networks may take a variety of forms. Fully autonomous fleets may be deployed through ride-hailing services and taxi liveries. Privately-owned AVs may plug into a mesh network whenever turned on or when they come within a certain distance of other AVs. Whichever distribution method puts them on the road, AVs will gradually mean fewer total cars being driven thanks to ride-shares, carpooling, and the ability for the network to recognize shared destinations for passengers and so pickup along the most efficient paths. A recent Center for American Progress research report cites an MIT City Lab study on AVs in urban settings to conclude:[xvi]

“Fully autonomous vehicles incorporated into ride- and car-sharing programs—known as shared autonomous vehicles—could reduce the number of vehicles on the road 80 percent while still getting every passenger to where they need to be, when they need to be there.”

Fewer cars and less traffic means less carbon in the atmosphere. The additional environmental kicker, of course, is that the majority autonomous vehicles being developed and introduced today are 100% electric or hybrids. Since the Nissan Leaf, we’ve already experienced the redesigning of the vehicle to maximize energy efficiency throughout their systems. We’re still years away from this hyper efficient transportation, however, the foundational steps are being taken today by big tech companies and entrepreneurs alike. The next time you’re in the BK Navy Yard try out the Optimus Ride autonomous vehicles in operation there.

Farming Goes Vertical and Aquaponic

A particularly hopeful area of innovation today is in redesigning our agricultural structure and process. The traditional farming industry discussed earlier via which we all eat is as massive as it is efficient. It’s loaded with layers of lobbyists and subsidies that have aided in ensuring our continued dependence on it. Many of the emerging ag innovators, however, don’t enter the market as threats to either Big Ag or local farming. Much like the potential integration of autonomous vehicles into Big Auto, these new methods can be the next evolutions of the existing industry especially if they find processing and distribution partners in the existing agriculture establishment.

Vertical, indoor farming provides growers direct controls over many of the natural variables – sunlight, rainfall, temperature – that are becoming unpredictable due to global weirding. As the name indicates, vertical farming is uses significantly less square footage and does not put repeat stress on soil the way that field farming tends to do. This dynamic also makes vertical farming viable in urban areas, reducing the cost and carbon-emissions of harvest delivery to cities. Bowery Farming and Freight Farms are two leading startup examples. Another even newer indoor farming system is the aquaponic farm system. These maximize yield and sustainability at each farming cycle stage. The most complex examples are integrated symbiotic systems: the nutrient-rich water from raising fish provides a natural fertilizer for plants grown, the plants in turn help purify the same water that circulates back to raising the fish. It’s fascinating to see and there are many local examples.

I believe it’s crucial that these potentially transformational new farming techniques not be seen or positioned as ways to sustain agricultural supply to overwhelming demand in a world that’s losing its naturally arable land or predictable rainfall. These methods should be viewed as evolutions of the industry that, with the proper marketing and distribution, can help make farming as sustainable as it is productive.

Part III. When Our Powers Combine

Four Changes Everyone Can Make

I’m going to conclude with four dead simple, everyday changes that everyone can decide to make and commit to continuing today that absolutely will help end this crisis.

1. Skip meat twice a week: if everyone in the U.S. did this, it would achieve the carbon emissions equivalent of taking all the cars, trains, and planes out of operation for a year. Just think about that for a second. Its remarkably easy to not eat meat two out of seven days. Its also way healthier for you to eat more plants, more often.

2. Recycle correctly: Everyone knows how. Separate your plastics and metals, your compostable trash, and your papers. Pro tip 1: done correctly, your recycling bin will likely be much faster to fill up, so have a larger bin for recycling and a smaller one for compost. Pro tip 2: recyclable papers include all types of cardboard, especially pizza boxes. Just do this. I know, laziness and selfishness is a thing and it’s much more tempting when your home alone and no one is looking. Hold yourself accountable for the few extra seconds it takes to recycle.

3. Carbon credit your air travel: If you fly often for work or pleasure, this action is as easy as clicking yes on the insurance option while booking a flight. The additional cost is minimal and, if its work air travel, you aren’t paying for it.

4. Stay Informed: Climate change maybe the only issue that entered the Fake News era already saddled with myriad claims that it’s not real. Poorly informed participants will cut the legs out from under any of the above efforts. Read, listen, and stay up on these issues.

—

end notes:

[i] https://public.tableau.com/profile/zillow.real.estate.research#!/vizhome/TotalMarketValue/States

[ii] https://www.huduser.gov/portal/ushmc/hmi-update.html

[iii] https://assets.floodiq.com/2019/01/a22bd29b007a783c7d3fa7f5c4531c9a-ne-homevalue-loss-slr.pdf

[iv] https://assets.floodiq.com/2019/01/a22bd29b007a783c7d3fa7f5c4531c9a-ne-homevalue-loss-slr.pdf

[v] https://census.gov/history/www/reference/maps/population_distribution_over_time.html

[vi] https://www.fema.gov/media-library/collections/339

[vii] https://en.wikipedia.org/wiki/List_of_natural_disasters_in_the_United_States

[viii] https://www.globalagriculture.org/report-topics/industrial-agriculture-and-small-scale-farming.html

[ix] https://www.worldbank.org/en/topic/agriculture/overview#1

[x] https://www.weather.gov/okx/CentralParkHistorical

[xi] https://www.nytimes.com/interactive/2019/09/11/us/midwest-flooding.html

[xii] https://www.engineering.com/ElectronicsDesign/ElectronicsDesignArticles/ArticleID/16694/Oil-Company-Says-Renewable-Energy-is-Cost-Competitive-with-Fossil-Fuels.aspx

[xiii] https://www.epa.gov/ghgemissions/global-greenhouse-gas-emissions-data

[xvi] https://www.americanprogress.org/issues/green/reports/2016/11/18/292588/the-impact-of-vehicle-automation-on-carbon-emissions-where-uncertainty-lies/

Human Nature and Consumer Demand

When the inputs change, the outcomes do too. The innovations that produce smarter, faster, cheaper for sectors like education, personal finance, and health-wellness may look and function in ways contrary to or at least diverging significantly from what’s come before.

This past summer I spent some time learning about genomics from a frontier tech perspective seeking to identify areas of startup opportunity. It was fascinating to be a complete noob in a sector and absorb all of its complexities as best I could. During those months, there was one very specific consumer genomics product that I found frustrating: DNA-informed exercise plans. The question of how much our genes can inform and improve how we exercise today is not the subject of this post or what nagged at me. I couldn’t see past a more fundamental piece of the human condition that the genomics for personal fitness products seemed to have left behind in the all-out effort to market from the cutting edge – people don’t skip the gym because their workouts aren’t hardcoded to the order of their nucleobases. People skip the gym because it’s easier than going. The negative impact of skipping is not clear or felt in any immediate term. The health and fitness upside of going takes a long time to realize and consistently going takes consistent effort. In short, it felt that DNA-based workouts may have unknowingly dismissed the core challenge of motivation. Human error is the largest problem waiting to be solved by consumer fitness startups.

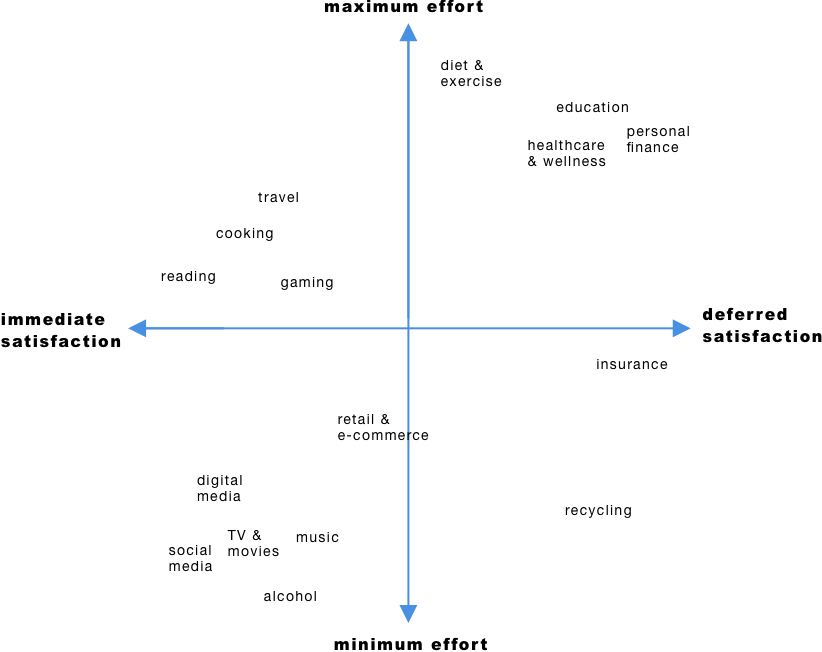

I started thinking more broadly about human nature’s influence on consumer sectors when reviewing this chart from Bureau of Labor Statistics data that Fred posted last October. What stands out to me, aside from the clearly diverging cost trends, is that the goods and services categories with dramatically increased costs also belong to sectors that require more participatory effort from the consumer in exchange for deferred outcome gratification. Conversely, the goods and services with steep cost reductions generally belong to consumer sectors that deliver much more immediate gratification with relatively minimal effort required. Referring back to the BLS chart, consumer preference (and so demand and so increasingly affordable goods and services competing for that spend) has clearly been for sectors that don’t require a lot of effort and deliver their positive impacts relatively quickly. See: TVs, Toys, Clothing, Smart Phones. In an effort to show these dynamics more clearly, I came up with the following graph and plotted a few consumer sectors here:

The x-axis represents the range of time to satisfaction from immediate to deferred. The y-axis represents the amount of consumer effort required to engage in or otherwise utilize goods and services in a given category. There is nothing scientific or data-backed in my graph. I’m just using this framework to illustrate my thinking. The categories that fall into the bottom left quadrant (lowest effort, fastest satisfaction) have sustained mass market consumer demand with two beneficial resultant effects for the consumers. First, highly competitive markets produce a greater variety of goods and services to choose from and lower prices paid for those goods and services. Second, these categories have delivered some of the most significant consumer startup successes ever (Facebook, Twitter, Instagram, Amazon, Netflix, Spotify and many others). By contrast, the categories in the upper right quadrant, in addition to seeing a spike in costs, have not yet experienced as direct a benefit from the foundational technology innovations of the past two decades.

I don’t believe this is due to lack of trying. I believe it’s due to the root human motivation to choose or engage in sectors that satisfy quickly with ease. We humans are real-time, me-first, me-now consumers. We want what we want when we want it. We stream more than we read, we use social media more than we exercise, we drink more than we recycle. Looking back through the lens of the effort vs. satisfaction graph, it makes a lot of sense that social networks and marketplaces have sustained a dominant run both in venture-backed outcomes and public market appetite and enthusiasm. Both sectors and their internet-enabled advances facilitate expedited or near-instant consumer satisfaction with less and less effort required. The same thinking can be applied to the usage and saturation of the smart phone. By no means am I dismissing any other quadrant on my graph. Yet reimagined or more challenging categories like those in the top right have problems and so opportunities that technology can and will solve. I do believe, however, that there’s a trap in expecting that the breakthrough technologies and startup models that solved for the bottom left quadrant will be as effective in the upper right sectors. The consumer motivation and engagement dynamics are completely different.

When the inputs change, the outcomes do too. The innovations that produce smarter, faster, cheaper for sectors like education, personal finance, and health-wellness may look and function in ways contrary to or at least diverging significantly from what’s come before. It warrants a deeper examination of how these sectors operate before assuming that the answer is an app for that. Individual human nature is the essential creator of consumer demand. Demand establishes markets and drives competition. Competition combined with sustained demand fuels real innovation. As entrepreneurs and investors taking aim at these sectors, we may need to key into human nature more now. Working to evolve consumer perceptions and nurture nascent demand can lay the groundwork for building truly novel startups that solve the appropriate problems and advance whole industries.

Future of Data-Oriented Startups Panel, DataEngConf

I was recently sent this video of a panel discussion I participated in during Hakka Labs DataEngConf at New Lab, with Evan Nisselson, David Beyer, Matt Hartman, and moderated by Pete Soderling.

I was recently sent this video of a panel discussion I participated in during Hakka Labs DataEngConf at New Lab, with Evan Nisselson, David Beyer, Matt Hartman, and moderated by Pete Soderling.

Demand for Realities Technology

Over the past couple of weeks, I've spent some time at the VR Bar in my neighborhood. I was pretty fascinated when I saw their logo on the street sign outside and it was a first for me to walk into an empty, white storefront that's open for business…

Over the past couple of weeks, I've spent some time at the VR Bar in my neighborhood. I was pretty fascinated when I saw their logo on the street sign outside and it was a first for me to walk into an empty, white storefront that's open for business. Its a really fun time in there. My first visit was my only one putting the headset on though as I was more interested in seeing how all the other people that came in experienced virtual reality in this setting and how they reacted. Most were curious and excited when they walked in and awestruck when they left. Almost all were VR first-timers. Maybe that's not surprising for now but, from an admittedly tiny sample set, it was evidence of the mass audience stance on virtual entertainment. They're ready for it but they aren't yet daily patrons of the VR Bar.

Picking through why this is the tepid state of mass consumer behavior regarding virtual and augmented reality has been done a bunch already. I thought it would be more interesting to try to identify sectors displaying the potential for immediate adoption and enduring engagement with reality technologies. I did this by calling or talking to people in eight different industries that it seemed to me would benefit from ar/vr. Doing my best not to ask leading questions, I thought these insiders would either confirm or deny that potential in describing their industry's status quo. From my conversations, two industries in particular have functional, physical world limitations begging for reality tech improvements: education - specifically history and natural sciences - and the arts and entertainment sub-sector of museums, galleries and historical sites. Here are a few soundbites from what they told me:

"History is boring! And I mean that with affection. It is a subject that literally can't jump off the textbook page. So my students are left to come up with their own mental visualizations of the places, things, and people we study with very little ability to have a direct or palpable experience with any of them."

- My High School U.S. History Teacher

"Regarding both initial training and advanced research, I'd say most life sciences, especially the biologies are at the mercy of the microscope and the limitations of human small motor skills. The technology and tools we have as scientists today are outstanding and profound, but its hard to teach or take an entire course with one eye closed squinting into a microscope."

- Biology Professor, City College of New York

"In the past three years or so, we've seen a nice uptick in attendance by shifting the museum-going experience to a digital-enhanced one that driven through smart devices, phones, tablets, headphones. The next wave as I see it would be a more constant blending of the real works of art and artifacts that we display with the virtual manifestations of the worlds, peoples, and ideas those pieces represent."

- Assessment Analyst, American Alliance of Museums

I don't believe that realities technology requires all-or-nothing levels of consumer adoption to translate into a sustainable, growing industry. The date in the future when there's headset in every home (or room) will be a tremendous marker of the technology's saturation, but that future does not preclude virtual and augmented reality products from bringing unprecedented value to existing sectors. The quotes above represent three such areas for which the core tenants of why they exist at all would be made stronger and more applicable right now with realities technology. There are undoubtedly many more examples of obvious application or stated sector demand.

Technology is transformative. Novel technologies can take us from our known present into a reimagined, remarkable future. VR and AR actually transport us to parts unknown, creating fully realized, virtual realms for us to explore unlike any concrete reality that most of us have ever experienced. This is fascinating and amazing. Though such profound technology should not be marked as a failure or cast off as ahead of its time up until the day when it has shown every one of us these expansive, new worlds. Paradigm-shifting technologies break down existing barriers to the knowledge, people, and phenomena of the present world along the way to that remarkable future they create.

Bedrock to Breakaway

The attraction to an 'up-and-to-the-right' trajectory can become toxic when maintaining it obscures the realities of a given market or business model. As a cool new startup gets more media coverage and ever-larger rounds of investment, zealous enthusiasm can quickly become unrealistic expectation…

There's some really encouraging funding news this week. Good Eggs announced a new $50 million venture financing on Tuesday, led by Benchmark with many existing investors participating alongside. This new capital comes almost three years after the company wound down its daily operations in every major U.S. city with a skeleton team at its San Francisco HQ. Its impressive to learn that Good Eggs has persevered since that downsizing and earned fresh financing to continue to build and evolve. What I found most meaningful was this soundbite:

"We spent the first eight months of 2016 solely focused on bedrock foundation, so the board didn't have a single conversation about growth." - CEO Bentley Hall

As it relates to a quote from the 2015 news that Good Eggs was shuttering the majority of its operations:

"The single biggest mistake we made was growing too quickly, to multiple cities, before fully figuring out the challenges of building an entirely new food supply chain." - Co-Founder, Former CEO Rob Spiro

Once a startup goes to market, often raising successive venture rounds, there's tacit acknowledgement that its foundation is sound. Fundraising pitches and board meetings generally focus on plans and potential to grow from where a company is, not how it got there. There's a reason for this point of view. Growth is important. Its speed and velocity can mean the difference between failure and success. Even outside of the startup-vc industry this holds true. Aside from shorting, no one buys a stock that they don't expect to go up at some point. The advantages that accompany breakaway growth are many and as a result its highly sought after. Investors, expected to get a jump on next big things, search endlessly for an inkling of a future exponential growth curve. The attraction to an 'up-and-to-the-right' trajectory can become toxic when maintaining it obscures the realities of a given market or business model. As a cool new startup gets more media coverage and ever-larger rounds of investment, zealous enthusiasm can quickly become unrealistic expectation. With the buzz that our industry is capable of spinning up, that expectation can weigh heavily on a startup eager to deliver breakaway KPIs at every update, whether that's an internal all-hands, a board meeting, or a fundraising announcement.

The pressure to achieve maximum growth at any cost can have lasting, detrimental effects. It can compromise a company with a sound foundation if that company isn't yet structured to support a deluge of new market expansion. It can also artificially prop up a company with a weak foundation and give it the temporary appearance of outlier success, like how steroids work. In the event that a startup has cash stockpiles, these consequences may not become obvious immediately. Yet both create unsustainable scenarios in which clear execution in market becomes increasingly difficult. When the foundation goes, the wheels tend to come off. So, breakaway growth can effect break apart growth pressure.

I don't know the details of the Good Eggs story past or present and even with fresh funding their future remains to be seen. I do know it took being blasted through a gauntlet of growth expectation and nearly failing in the effort to deliver for Good Eggs to have to pause, reflect, and plan clearly. So many startups, similarly run ragged, aren't afforded a second act. Although there is a time when anyone can gather market intelligence, build models, stress-test assumptions, and layout strategy, structure, process, and plan for what's to be built and how it'll succeed in market: before starting up. Don't get me wrong, there's nothing more interesting and exciting then thinking about a new product, what will it do? what will it look like? how will I experience it? how amazing is it going to be? But just as crucial to creating this new thing you want to create is taking the time to establish a durable, intelligent, agreed-upon plan for pragmatic building towards sustainable growth. The decision to start a company is never made lightly. By laying down a bedrock, foundational plan for their startup before incorporating, every imminent entrepreneur can navigate the chaos with extra clarity and confidence thereafter.

Podcast Discovery

I was having breakfast with my friend Pat Keane recently and we started talking about podcasts and our shared frustration with new show discovery across the entire category…

I was having breakfast with my friend Pat Keane recently and we started talking about podcasts and our shared frustration with new show discovery across the entire category. Everyone who consumes to podcasts - both of us included - has a preferred place to listen. Many people I've asked lately go with what's obvious and native like Apple's Podcast app. I lack the discipline to download and delete shows, preferring to stream only and so I've been a Stitcher app devotee with a side of the Soundcloud app for pods that aren't on Stitcher. Before settling into my longterm preferences, I tried many apps and services for listening. In addition to those already mentioned, I've used Overcast, Podbean, TuneIn Radio, Pocket Casts, Downcast, iCatcher!, Pod Wrangler, and even Spotify. All are generally well designed throughout; none of them has solved for discovery via in-app UX/UI. Considering media discovery in other formats - streaming tv and movies for example - and it may be that the problem is neither unique to podcasts nor a symptom of limited design.

Searching for a new podcast can be a struggle akin to endlessly mining Hulu app or HBO Now for something to watch. Depending on mobile or desktop view, 9 to 15 title card rectangles are all anyone has to go on, these single images become difficult to recall or differentiate once scrolling begins. The design restraints in option-selection display are shared across the spectrum of digital media browsing. Devices only have so much screen. Thumbnail title images aren't a fair representation of what's great about a show. Yet, people surrender lots of time to scanning Netflix. The issue for podcasts then may be that the medium has not yet delivered a critical mass of blockbuster content that's necessary to encourage listener browsing.

Word of mouth is a marketing mechanism as yet unmatched in its ability to convert. This is true across any purchase or participation category and its particularly obvious in the realm of digital entertainment. In February of 2013, Netflix dropped an an adaptation of a popular British series called House of Cards - its first original series and first time releasing a full season all at once. The buzz was immediate and for a few weeks its all anyone could talk about. Everyone watched it. Since that month, Netflix has released Orange Is The New Black, Bloodline, Stranger Things, The Get Down, The Crown, The OA, 13 Reasons Why, Ozark, and Mindhunter, just in the original, fiction category. Not everyone watched all of them (except me) but you probably watched more than one and many, many people you know did too. These shows, and many of the wildly popular standup and documentary specials, gave Netflix a word of mouth superpower along with consistent audience satisfaction to back up the buzz. There are amazing new shows and movies to stream with more coming and its on Netflix.

Podcast, as a category, has not yet had the big bang moment that House of Cards created for Netflix. Serial was a glimpse of that moment but the show did not have staying power nor was it followed by a succession of shows with similarly cross-demographic, obsessive appeal. Netflix and increasingly all of the streaming platforms are known to have a plethora of content, seemingly more and more everyday. Audiences then are confident they'll find something interesting when they log-in, even when they don't have a specific idea of what they want to watch. Podcasts haven't hit a volume threshold to earn that confidence from listeners and so drive them into their podcast apps in search of regular entertainment. Without that recurring action, there's too much distance between podcast interface and podcast audience for discovery to take place.

Avoiding Venture Overdose

At its best, venture capital can be an amount of new cash from new advisors, both additive, short-term growth resources. At its worst, venture capital can resemble these benefits but turns out to be an over infusion of cash…

At its best, venture capital can be an amount of new cash from new advisors, both additive, short-term growth resources. At its worst, venture capital can resemble these benefits but turns out to be an over infusion of cash - potentially crippling to a company - from some new advisors with whom founders were actually misaligned from the jump. In the fall of 2016, Eric Paley wrote a meaningfully transparent piece on the toxicity of overindulging in venture financing titled venture capital is a hell of a drug. In his post, Eric reinforces the point that the outcome for startups that inhale supersized venture rounds early and often is usually the graveyard, not the pantheon. Nonetheless, many startups still fail when blind to the longterm downside of too much venture money.

It's counterintuitive in a consumer culture to believe More < Less. When it concerns money, this equation runs diametrically against societal perception of value. And so it is for technology startups and venture capital. Offers of larger and larger investment must be a good thing, right? Don't get me wrong, its challenging to argue against all-powerful pots of gold that can be elusive to startup founders. However, the brutal effects of too much venture investment are often obscured by the same human error that makes us covet more of everything. All parties get cartoon dollar sign eyes. The press sings your praises for landing a mega round; your employees get excited about more resources and larger salaries; many who only see the headline anoint you as rich and tell everyone they know that you're crushing it. Adoration is a human want and for hardscrabble entrepreneurs its tough not to be drawn to a spotlight and stage that's calling for you. And, of course, in the aftermath of a gigantic venture raise, there are literal benefits to founders as well - notably some form of significantly improved compensation.

In keeping with long-term value over short-term financial windfall, there are some questions you can ask of any investment offer to help you make a final decision within a sane bounds of benefit to your company:

Do you really need this much money?

This one should be an internal founding team question to discuss. No doubt, it's hard to resist fitting future scenarios to the money offered. But up to a ceiling of the no bs, most immediately achievable forward growth rate, work back to realistic maximum possible operating and capital costs for the 12, 18, 24 months ahead. Give yourselves a 10-15% buffer, or something within reason for your company, to account for unforeseen costs and/or a breakaway growth trigger.

Do they really believe you need this much money?

Before a specific amount of capital is suggested, it's reasonable to ask the firms offering funding to collaborate with you to understand what amount of capital will achieve an optimal future for your company. After you receive a term sheet with investment numbers defined, it is reasonable to ask the firms involved why, at the stage your business is today, this amount of capital will achieve an optimal future for your company.

Some of the best firms will have already run through future outcome scenarios based on different amounts of capital invested. In those cases, you should feel more confident in a true alignment with potential new investors around a large cash infusion as you make your decision about taking new money and how much you'll take. The point though is not to push VCs to do more work or show their work done. The point is to help you build conviction in the decision to take a large investment. Firms that cannot provide insight into why their offer is the healthiest choice for your company should give you pause. Sometimes, VCs have too much money to deploy and are eager to record paper valuation markups in their portfolios, sometimes at the expense of sound business decisions for the startups they've backed. Sometimes, firms just get competitive and want to win the deal so they outbid one another and your funding round gets bigger and bigger, for no reason that's related to your company. Pushing potential new investors on this question and related exercise should help provide a fuller picture of the motives behind an outsized venture financing offer.

Do they really believe in you, your business, and its continued potential?

This is a more qualitative alignment consideration. Understanding that you only get so many interactions with the people behind the capital before an investment offer is made, you should ask them questions that probe for their excitement and conviction in your specific company and your vision. And its perfectly fine to push them beyond positive overtures, buzzword regurgitation, and cordial niceties. Naturally, you always want investors that believe in you through thick and thin. Often, investors do things like 'chasing heat' or 'taking a flyer' in which they want to invest in you primarily because their peers are (chasing heat) or primarily because they don't want to miss out on some future exit (taking a flyer). If firms are offering you money without discernible interest and belief in what you've built and where its all going, that should give you pause.

---

A common VC advice soundbite is 'raise as much as you can' or 'raise it if you can'. Its easy to have a head-nodding immediate reaction because it makes practical sense at first blush. Upon deeper consideration, its really only valid in a few cases, the most common being when the external financial markets signal that you should or that you have to 'raise as much as you can'. Examples are an impending economic recession or a tech-startup bubble bursting. Here the advice is to raise more now because you might not be able to in the near future. In the many, many other cases when this advice is given its not correct and it has become so generalized as to disregard any one company's specific circumstances. As hard as it can be in practice to rationalize saying no to more, endeavoring to be more pragmatic and honest in consideration of a large venture investment will serve you and your company well for years to come.

A Streaming Watershed

On Sunday, Netflix dropped a trailer for 'Cloverfield Paradox' during the Super Bowl with a premiere date of: available to stream that night right after the game. Paradox is the third film in a big budget, CGI-action franchise - the first and second films premiered in theaters and earned a combined $280 million at the box office worldwide. This movie will never play in theaters.

On Sunday, Netflix dropped a trailer for 'Cloverfield Paradox' during the Super Bowl, with a premiere date of: available to stream that night right after the game. 'Paradox' is the third film in a big budget, CGI-action franchise - the first and second films premiered in theaters and earned a combined $280 million at the box office worldwide. This movie will never play in theaters.

Premiering a movie online is pioneering and Netflix took every opportunity to demonstrate why they got to do it first. Software-based online distribution lets Netflix shrink the 'trailer-to-open' movie promo calendar from a couple of months to three hours. A product with DNA that's direct-to-consumer and on-demand, Netflix can take bold aim at large, live audiences and deliver. The single largest TV audience every year tunes in for the Super Bowl, a last predictable bastion of mass cable viewership for many incumbent broadcast competitors. Regardless of the film's reviews and reception - exceptional movies and shows are platform agnostic - the move is a big, bold notice that our streaming future is at hand. The doors seem wide open at this point for blank-canvas creativity with media distribution-consumption models. The film and TV industry as a whole has arrived at a fascinating, tectonic mega shift as it adjusts to distinctly new consumption behavior and an overall gargantuan demand for more that has manifested.

A quick look at the state of the streaming-cable viewership tug-of-war in the U.S. shows that cord-cutter and cable subscriber numbers are growing and declining at the same average rate over the past five years. Duh. The more interesting stat is the steeper curve of a newer customer-market segment, individuals who have never paid for or had exposure to traditional cable services: the never cords. In The diagram below, two data points stand out. The first is the point in 2022 where the total number of never cords surpasses the cord cutters and never looks back. The cord debate will be moot as future generations grow up never experiencing a cable cord.

data source: emarketer.com

The second notable point is actually not graphed, the inevitable date when the total number of non-cable viewers surpasses cable subscribers. My graph is a ten-year projection that keeps the rate of change constant, based on the trailing four-year average delta for each of the three segments graphed. There are a few reasons to expect future periods that significantly accelerate the various rates of change in the graph:

The aging of the baby boomers is a double dagger for cable. The generation is both literally a large group as well as a disproportionately large demo of total cable subscribers.

Yearly growth spikes from successive future generations that increase the growth and size of the streaming-only segment exponentially.

Below are some more thoughts what else might happen as streaming takes centerstage in film and TV:

Good Times Ahead for Creators

The sources of funding for film and tv content now include tech's 'big five' - Amazon, Netflix, Apple, Facebook, and Google (via Youtube) - representing a combined market-cap of three trillion dollars. Those new tech dollars combine with the established studios, premium networks, and joint-venture streaming services that are in the Walt Disney or Time Warner umbrellas. These monster acquisition budgets reflect how seriously all of these companies are working to satiate and capture The Binge, or the huge audiences with huge appetites for all the shows and movies, all the time. Such a wealth of financial and distribution partners gives directors, producers, and writers a massive leg-up in an industry that traditionally takes its artists starving. Sharing back-end profit participation and final cut creative control should become table stakes for creators in financing negotiations. And, very simply, across the entire business more original stories will get greenlit, which is an amazing state of things.

Will 'All-You-Can-Eat' Pricing Survive?

A forthcoming saturation of great new content available on many different platforms may present a threat the 'all-you-can-eat' monthly subscription model that most streaming services employ. For example, if I hear about an amazing new show on Starz, I definitely want to watch it but I don't necessarily want to add another $8.99 monthly subscription to Starz. So unless I can binge that show during a free trial, I'm stuck. It's unlikely that streaming/internet consumers will end up stacking 5-10 streaming subscriptions that end up costing them the same or more than their old monthly cable bill. That starts to look like just another bundle with inefficient billing. Certain streaming services may need to experiment with ala cart pricing like iTunes in order to capture audiences. There may also be a future in which the streaming industry leaders collaborate on releasing content available on all platforms or offer multiple services in a single subscription bundle.

Do Streaming Brands Matter?

Audience loyalty to the services and platforms that deliver us moar shows and movies may become non-existent. I believe Netflix deserves credit for leading the push into streaming and is one of the few examples of a successful counterargument to The Innovator's Dilemma. However, platforms just like studios should be conscious of a much more direct line between audiences and content creators now. For the past fifty years, audiences had preferred stations, channels, or streaming services because those networks broadcast their favorite shows. That curatorial strength still matters but there's less reason for viewers to have a favorite content distributor when there is fantastic programming everywhere, which can often be seen on a number of different streaming services. The more that creative minds can speak, interact, and build loyalty with audiences directly, the better. However, can the platforms stomach becoming the afterthought access pipes for video content instead of the flashy new faces of online media?

OTT Ad Placement & a Display Land Grab

I've met a few startups working in the OTT - advertisement space. However, there remains a tremendous opportunity to establish a robust ad ecosystem for streaming and casting programming, both on-demand and live. Today, ads that run during broadcast TV breaks to streaming viewers are at best a mind-numbing loop of the same 2-3 ads for the entire program and at worst are just a static, pixelated network logo for 30 seconds. History would signal a coming land grab for all of the pauses and places within content streaming where companies can put or run ads. I am not one to advocate for ads anywhere, but its very clear that incumbent advertisers haven't done much to serve gigantic streaming audiences that they are losing from cable broadcast.

Discovery on Ever Smaller Screens

While more new content should be a good thing for the whole industry, without an evolution or expansion of how streaming services market new programming, discovery is limited to the home logged-in page on a laptop or phone screen. That's not much space to squeeze in thumbnail images of new shows or movies. There's lots of experimenting with novel ideas to be done here. Platform recommendation engines should be increasingly well-stocked with individual viewer's tastes. So, a version of the Spotify 'discovery weekly' playlist for tv and film recommendations would be an asset for companies offering streaming content. There is also reason to believe that some industry participants will look to the traditional marketing mechanisms that have traditionally worked - billboards, late night talk show circuit, and live programming spots. Its clear though that the virtually un-marketed approach that Netflix for example has taken with much of its original programming will be tested as streaming libraries become more and more crowded.

Creative Forecasting

Last year, I came across what I considered the most accurate and pleasant definition of the vocation of early-stage venture capital. It took me far too long to find it again, but I finally have…

Last year, I came across what I considered the most accurate and pleasant definition of the vocation of early-stage venture capital. It took me far too long to find it again, but I finally have. Borrowed from an early chapter of the book Originals by Adam Grant and remixed a bit for the purpose of being a stand-alone definition and not a phrase in a chapter in a book, this description of venture capital is one I hope to hang my hat on for decades to come:

Creative Forecasting

the discipline of predicting the success of novel ideas

Dot v. Mini

While startup twitter continues to be an amalgamation of thirsty AND extra over bitcoin in the run up to the end of the year, there’s another consumer technology that’s low-key (compared to BTC at least) arrived in the mainstream in the second half of 2017...

While startup twitter continues to be an amalgamation of thirsty AND extra over bitcoin in the run up to the end of the year, there’s another consumer technology that’s low-key (compared to BTC at least) arrived in the mainstream in the second half of 2017: the voice-activated, connected home. Three or four years ago, tech blogs went ham buzzing about IOT – internet of things – and the treasure troves of new data moats and transparent, efficient living that connected home devices would create. All and all, that didn’t really happen, due in some part to the big tech corporations staffing up via acquisitions including Nest to Google, Beats to Apple, and Vesper to Amazon in order to execute on the IOT future.